AI Agent for ModernFinance Professionals

Zavvis AI Agent automates financial workflows and delivers deeper insights—so you spend less time analyzing and more time making strategic decisions

Two separate solutions that are better together.

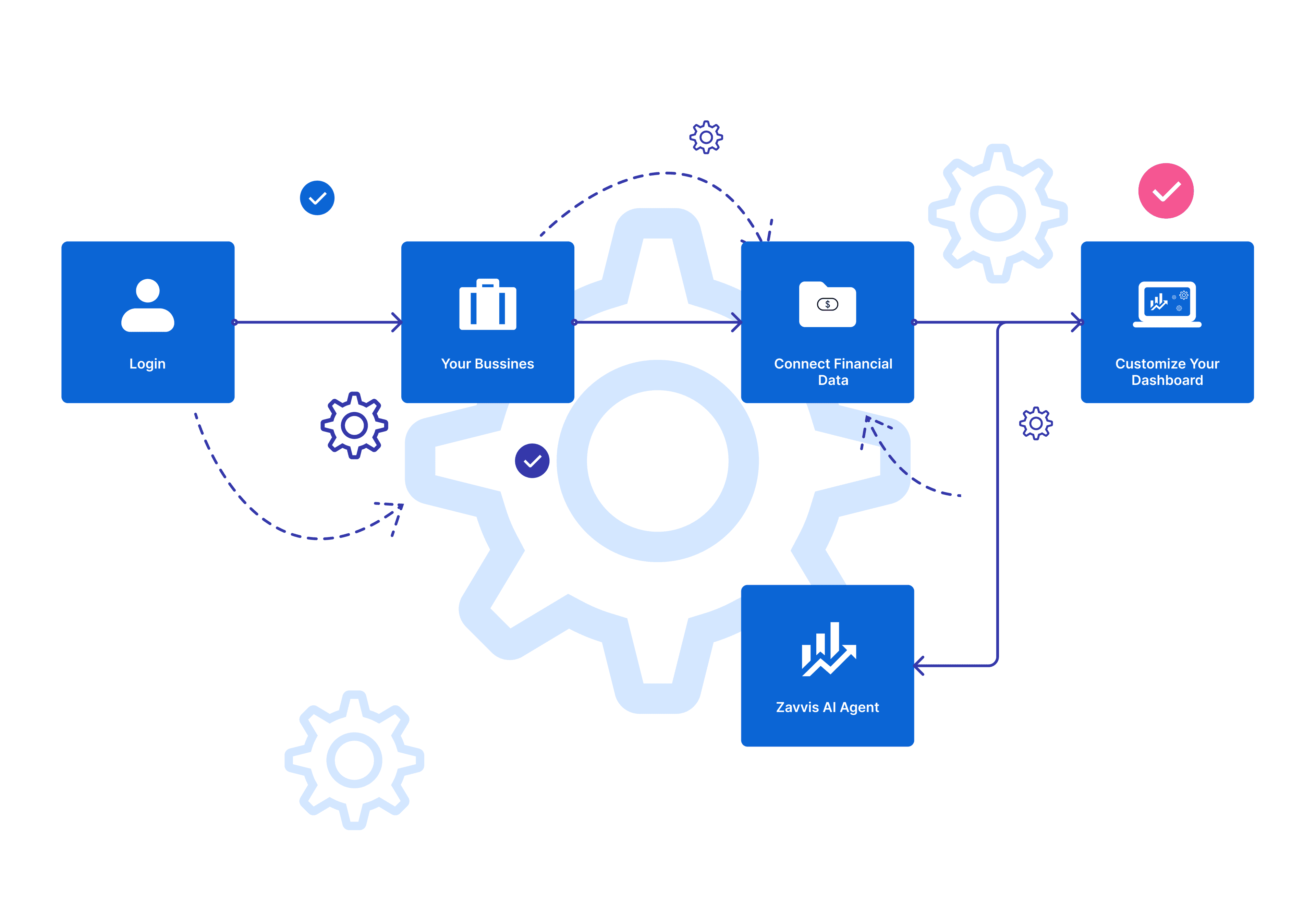

Zavvis takes the busywork out of finance—connecting to your accounting, banking, and CRM tools, scoring data quality in real time, and powering accurate analysis through our proprietary calculation engine. Zavvis Agent isn’t just pulling your data—it’s orchestrating it.

Workflow

Ideal For: Finance teams who want real-time visibility, smarter insights, and less time wasted pulling and cleaning data from disconnected tools.

See Workflow Orchestration

Zavvis AI Agent speaks up when it matters—surfacing the root causes of gaps in cash flow, performance, or capital readiness. The agent does the heavy lifting so you can focus on taking action and making smarter decisions.

Growth

Ideal For: Leaders who want AI to surface what’s slowing growth, unlock financing faster, and stay ahead of problems before they appear.

See Growth AutomationReal-Time Oversight

Zavvis continuously monitors financial systems across your business—flagging anomalies, burn changes, and financial risk the moment thresholds are crossed.Smarter With Every Interaction

With every journal entry and user input, Zavvis adapts—fine-tuning recommendations and automating responses that get smarter with your business.

Deeper Diagnostics

It doesn't just track history—it runs real-time models on forward-looking data to uncover risk patterns, growth potential, and operational inefficiencies.Strategic Execution

Zavvis recommends targeted, time-sensitive actions—whether to reduce burn, renegotiate terms, or pursue financing—based on data-driven projections.

Zavvis Agent Insights

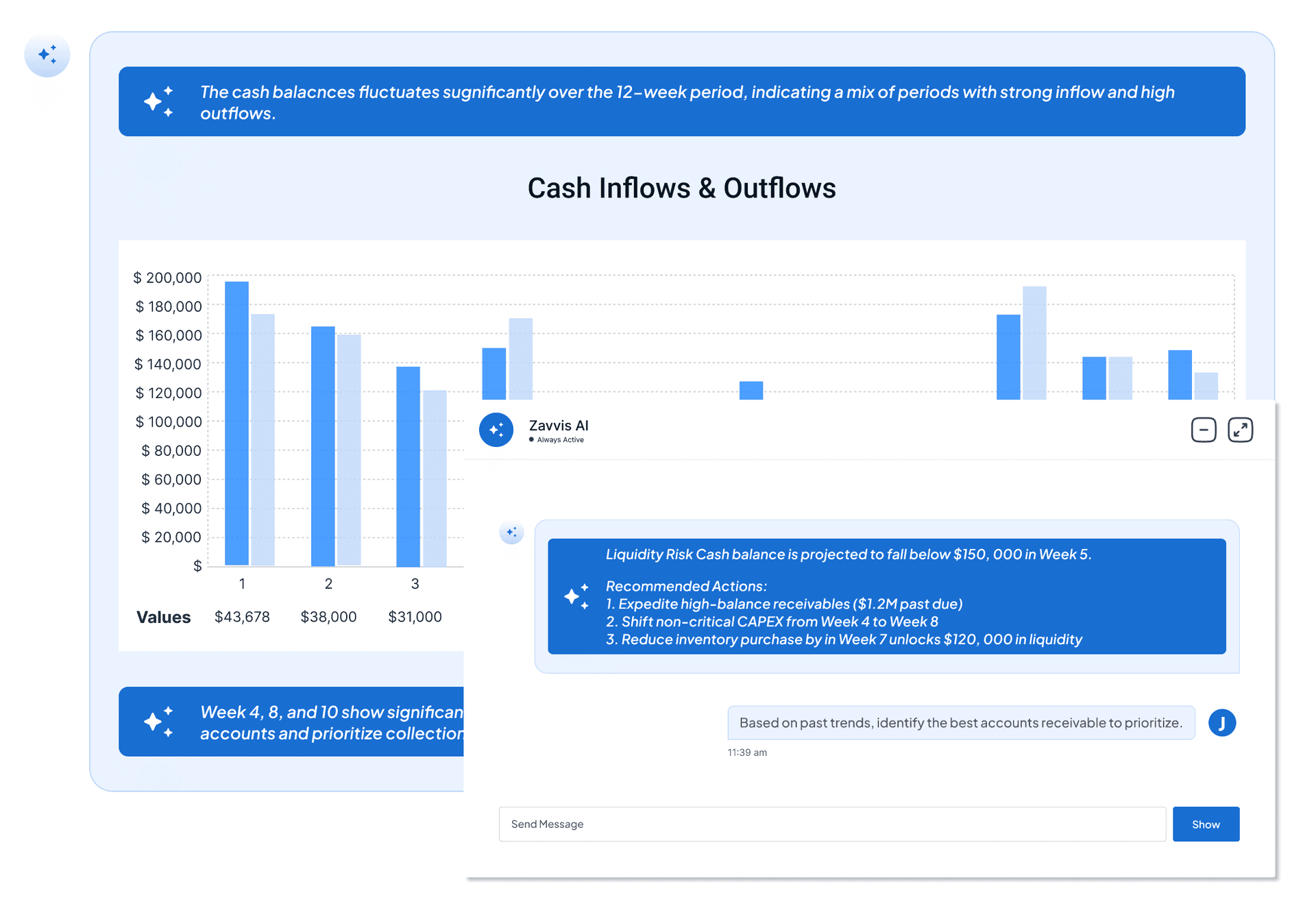

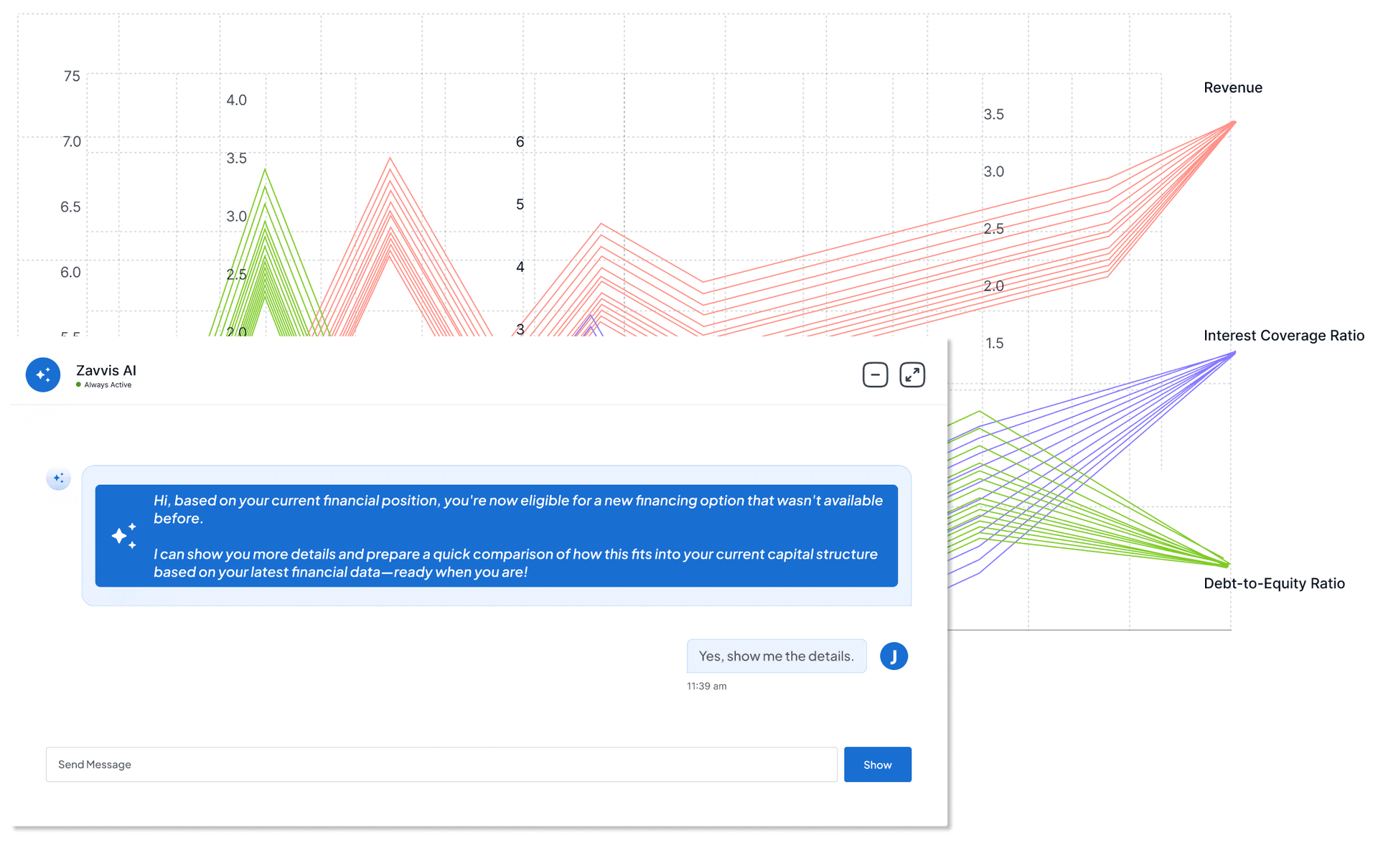

Faster Answers, Automatically

Chat with your data using natural language for deeper, faster analysis. Zavvis scans your financial data to uncover opportunities, detect risks, and deliver insights your team can act on instantly.

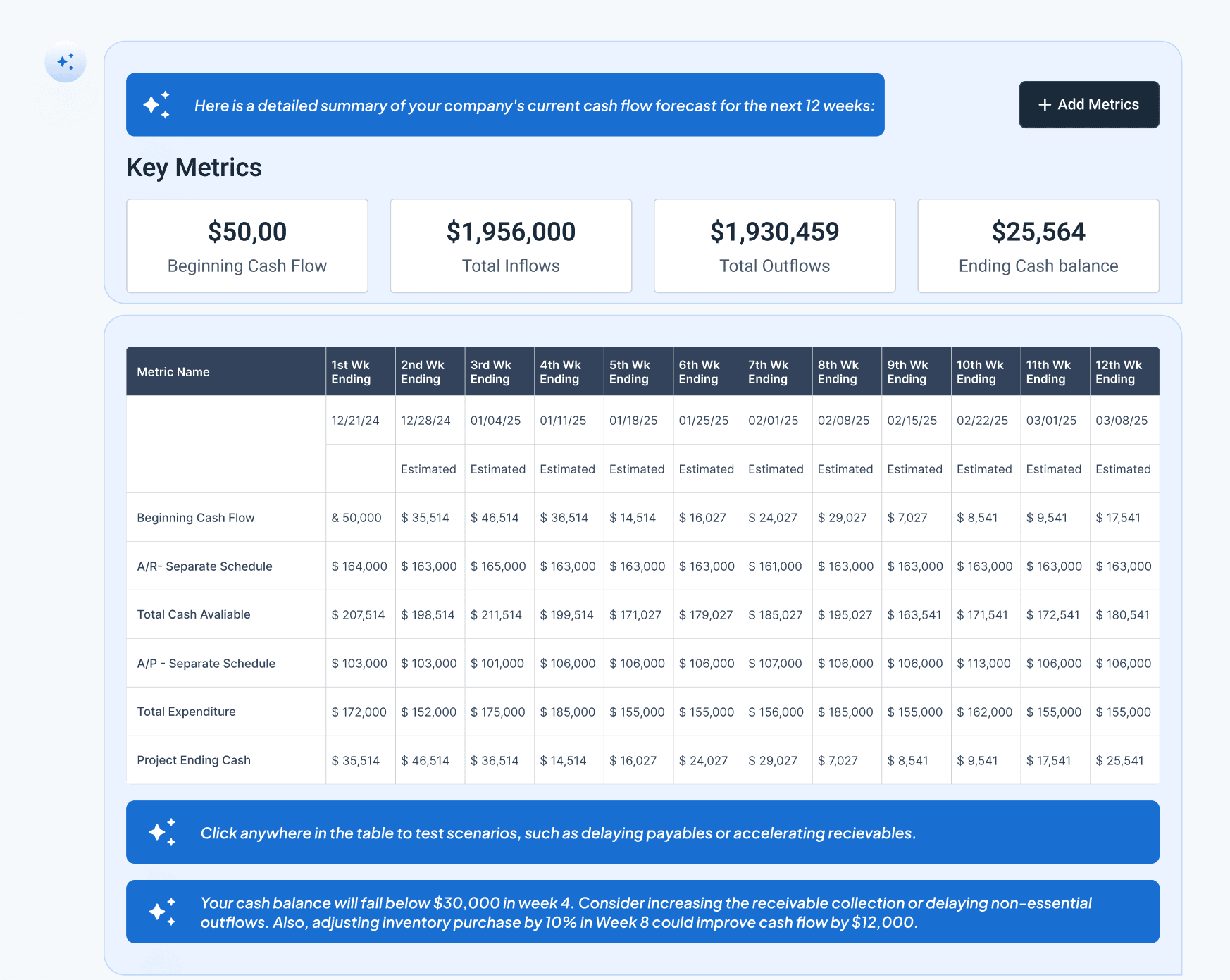

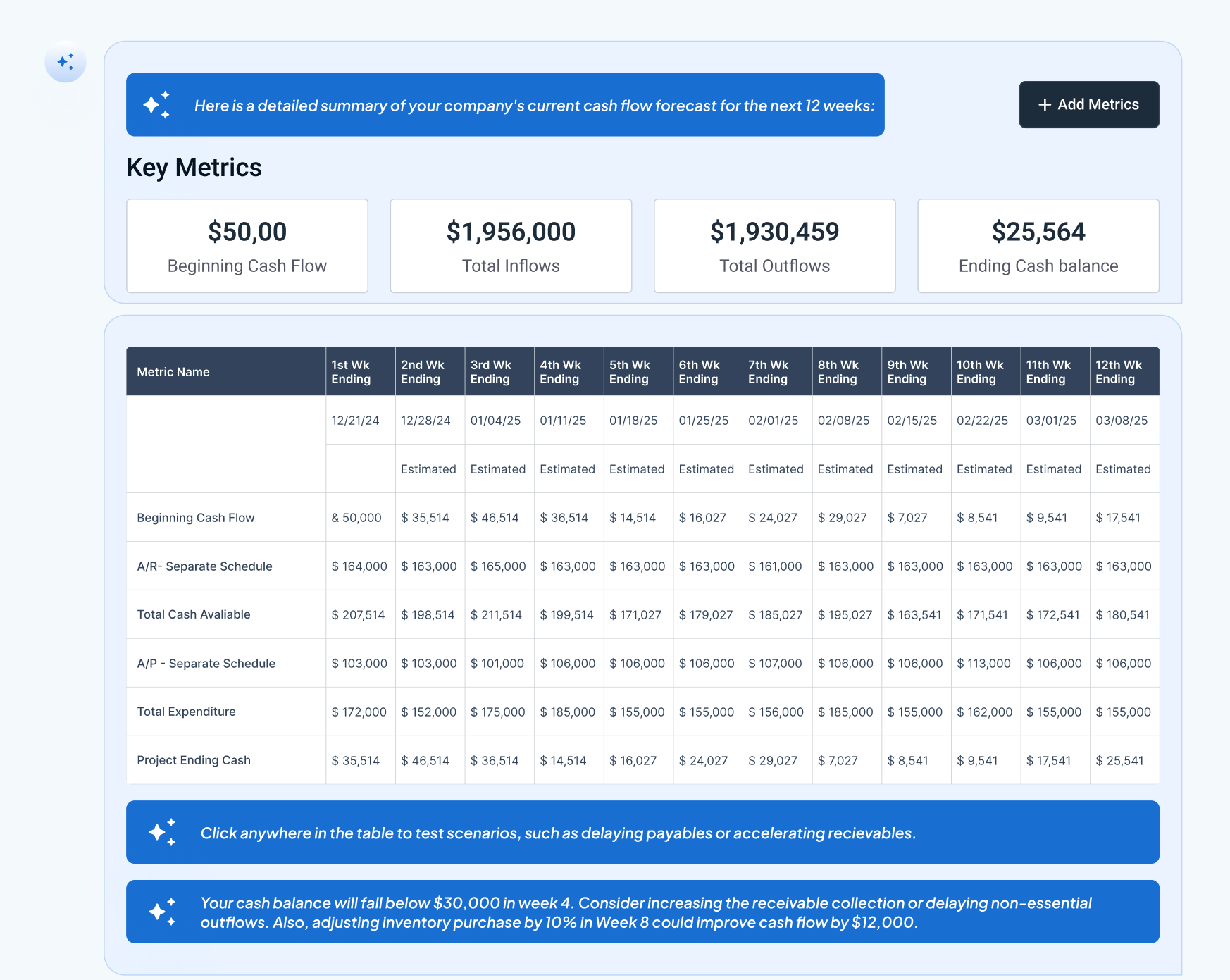

Cash Flow Management

Gain Control Over Your Cash Flows

Zavvis autonomously analyzes inflows, outflows, variances, and trends, alerting you early, modeling scenarios, and proactively guiding you through every decision.

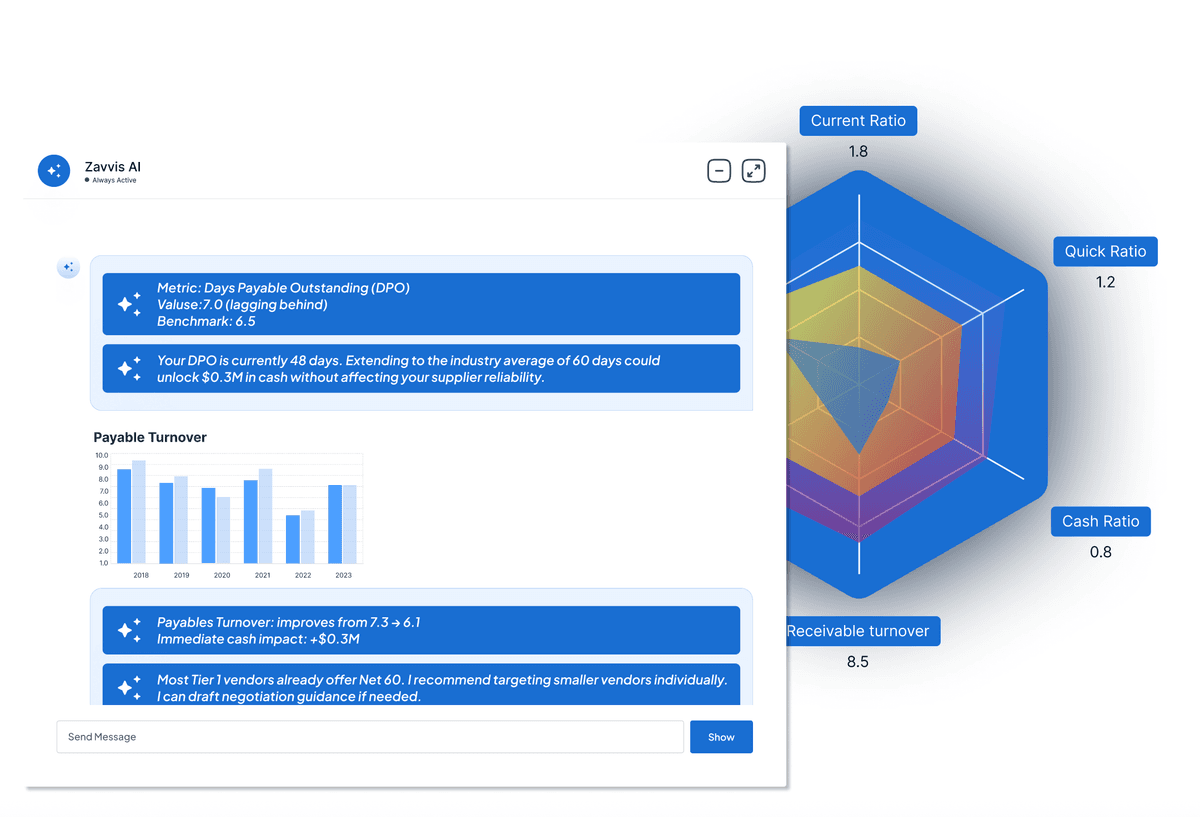

Benchmarking

Know Where You Stand and Where to Improve

Zavvis Agent benchmarks your performance, flags gaps, and recommends focused improvements to close them.

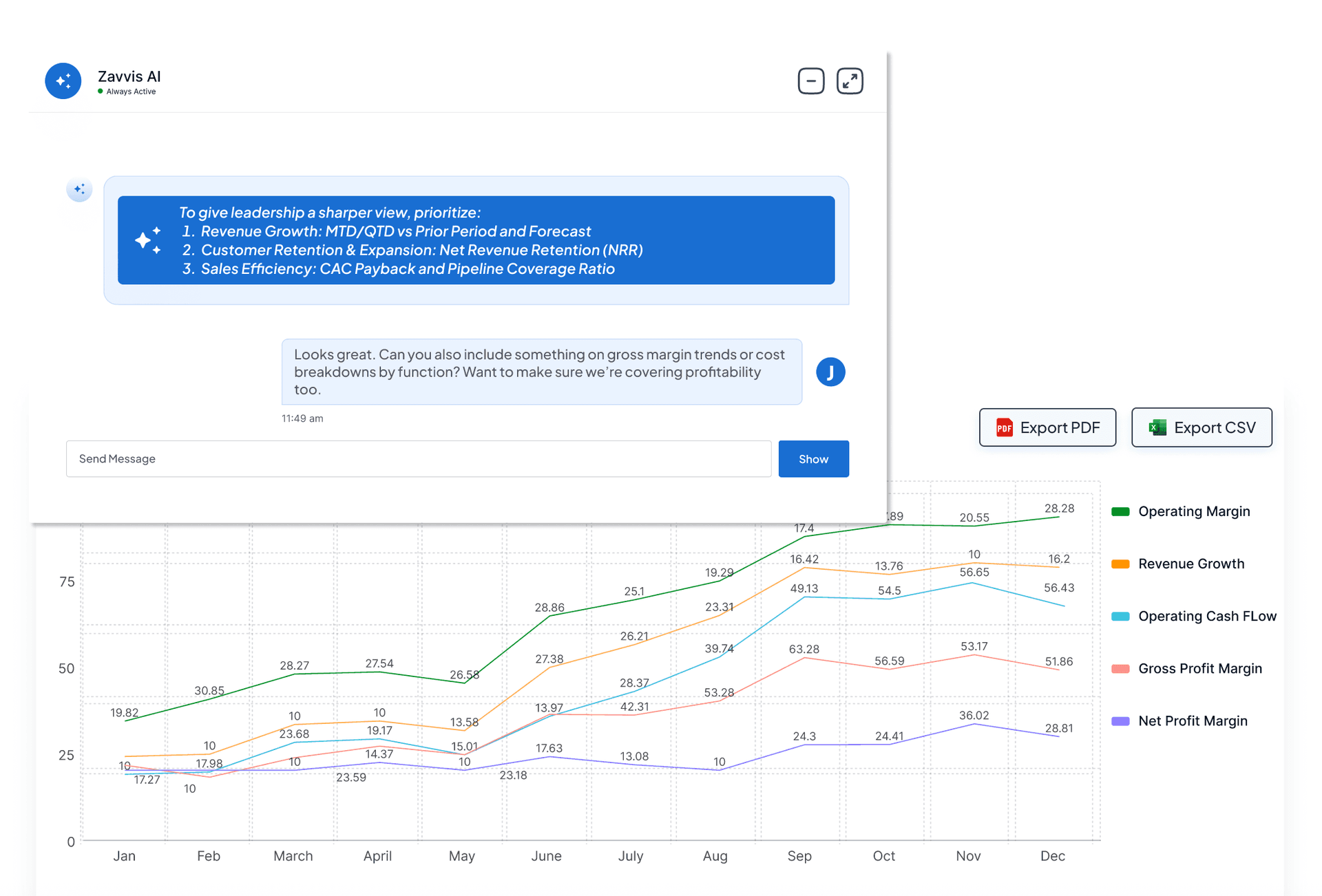

Financial Reporting

Turn Data Into Narrative

Share the story behind your financial data. Zavvis Agent helps you present key insights clearly, so your team stays aligned, informed, and ready to act.

Capital-Ready Posture

Beyond Insights. Built for Growth

Zavvis Agent helps your business maintain the financial posture investors and lenders look for. Then surfaces tailored funding offers from trusted partners at just the right time.

Intelligent Criteria Mapping

Zavvis understands the financial standards lenders and investors expect—then helps you align your metrics in real time.Ongoing Eligibility Signals

Zavvis constantly tracks performance indicators like profit margins, DSCR, and revenue trends—alerting you when capital readiness is at risk.Targeted Improvement Plans

Receive proactive guidance to optimize your capital structure and improve your standing for credit or equity financing.Document-Ready by Default

No more scrambling—Zavvis keeps your statements, forecasts, and key docs audit-ready and shareable with a click.Frequently Asked Questions

What is Zavvis and how does it support finance teams?

Can Zavvis replace my current financial tools?

Who uses Zavvis?

How does Zavvis keep my financial data secure?

How is Zavvis different from dashboards or reporting tools?

Our Client's Success Stories

Join UsZavvis helped us boost financial visibility and reduce cash volatility by 20% in just 3 months. A strategic upgrade for our operations!

Michael Ross

CFO at Luxury Space, IncReady to Unlock Your Business Potential?

Join the waitlist. Enter your email address and we’ll let you know when your spot is ready.